Upstream

U.S. shale output seen hitting record 6.95 million bpd in April – EIA

U.S. crude production from major shale formations to hit a record high 6.95 million bdp in April. This is the result of an estimated rise in 131,000 barrels per day, the U.S. Energy Information Administration (EIA) said in a monthly productivity report on Monday. That expected increase would top the 105,000 bpd increase in March from the previous month to what was then expected to be a record high of 6.82 million bpd, the EIA said. The expected increase in April is largely driven by gains in oil production in the Permian and Eagle Ford formations, according to the report. With this increase the U.S. shale oil industry is increasingly being seen as a disruptive, and potentially dangerous, producer related to the global supply balance. It’s unclear on how much OPEC and Russia can cut p...

Another headache for OPEC: Old fields find new life

Bob Dudley, in his 38 years in the oil industry, has never seen anything like what happened with BP Plc’s old fields last year: They gushed more crude. “I cannot remember ever in my career having seen a negative decline rate,” the British oil-giant’s chief executive officer said in an interview on the sidelines of the CERAWeek by IHS Markit energy conference in Houston. Dudley isn’t alone in seeing mature fields dwindling less than expected –in BP’s case surprisingly increasing — giving the OPEC one more thing to worry about. As if the shale boom wasn’t enough of a headache. Better results from legacy fields, also observed by producers like Royal Dutch Shell Plc and countries like Norway, further complicate efforts by petro-states like ...

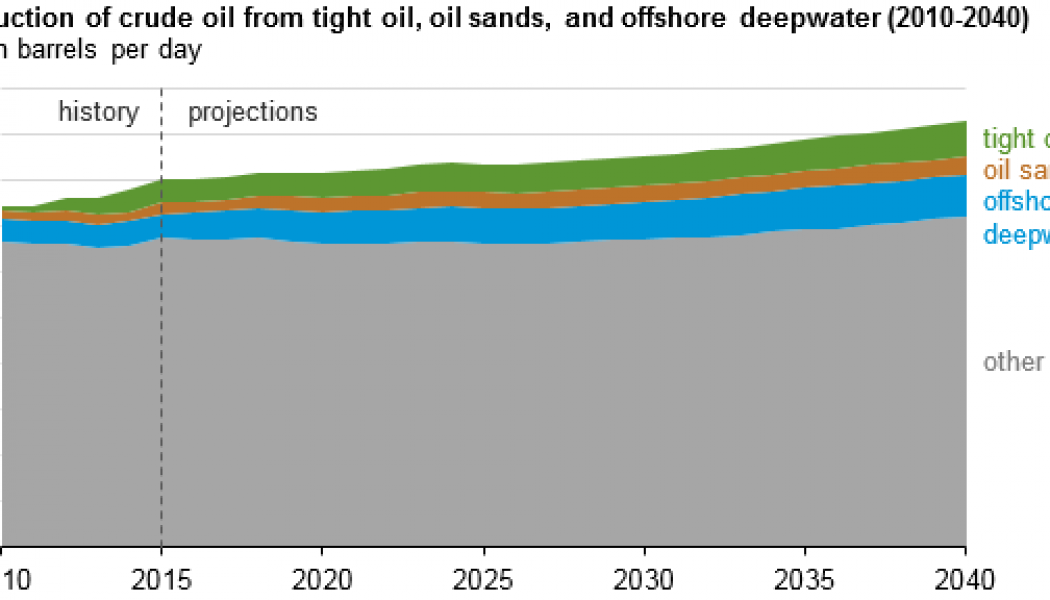

IEA Says Long Term Oil Production Growth Driven By Tight Oil, Oil Sands and Deepwater Investment

Upstream investment in crude oil and liquids production is highly sensitive to crude oil prices, particularly production of higher-cost resources from tight rock formations, oil sands, and offshore deepwater. In EIA’s International Energy Outlook 2017 (IEO2017) Reference case, increasing crude oil prices lead to more investment, driving production growth in these higher-cost resources. By 2040, EIA projects that the combined production from tight oil, oil sands, and offshore deepwater will reach 21 million barrels per day (b/d) and will account for almost a quarter of the world’s total crude oil production. From 2010 to 2014, global investment in tight oil, oil sands, and offshore deepwater development increased from 20% to 30% of total upstream investment. Over that same period, com...

First Oil, Now Natural Gas: U.S. Emerging As India

Its official – India will be importing its first ever consignment of U.S. liquefied natural gas (LNG), a mere nine months on from signing up for its first consignment of American crude oil. In a statement on Monday (March 5), coinciding with the first day of IHS CERA Week in Houston, U.S. – an event that’s considered one of the oil and gas sector’s signature jamborees – Cheniere Energy, a leading American LNG exporter, said it would be sending its first consignment to India via the Sabine Pass Terminal in Louisiana. The importer – Gas Authority of India Limited – one of New Delhi’s state-owned energy companies, said the takings would be under a 20-year sale and purchase agreement (SPA). […] Read Full Article Here: https://www.forbes.com/sites/gauravsharma/2018/03/05...

OPEC wants to talk with rival US shale drillers to learn lessons of downturn

OPEC wants an open dialogue with U.S. shale drillers after the most painful downturn in six oil price cycles. OPEC was meeting with rival U.S. shale producers on the sidelines of the annual CERAWeek energy conference for a second year in a row, in an effort to learn what the industry can do to avoid the type of painful downturn faced in 2015. Read Full Article Here: https://www.cnbc.com/2018/03/05/opec-wants-to-talk-with-rival-u-s-shale-drillers-to-learn-lessons-of-downturn.html

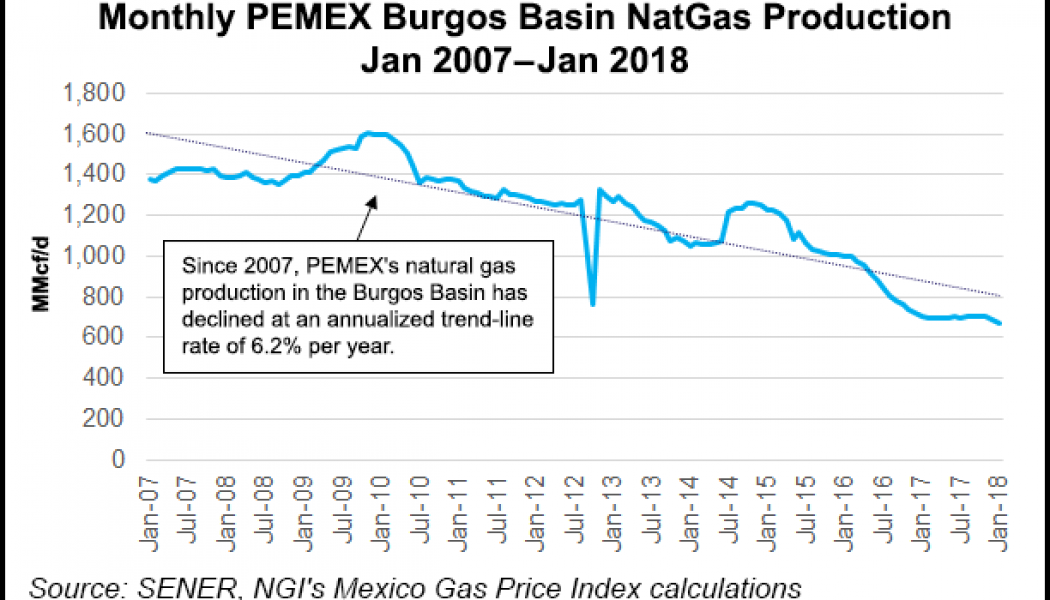

Mexico Ramps Up for Historic Round 3.3 Unconventionals Auction

Mexico’s energy authorities have taken a bold initiative by inviting tenders for the nation’s first auction of unconventional resources of massive but thus far unrealized potential and fraught with potential problems. Read Full Article Here: http://www.naturalgasintel.com/articles/113575-mexico-ramps-up-for-historic-round-33-unconventionals-auction

Putin’s power play: Russia-Saudi oil deal a launchpad for bigger Russian influence in Mideast

Saudi Arabia’s oil production agreement with Russia was opportunistic at first, but it is now the foundation for a broader relationship. The full article, linked below goes into greater detail. The quote of the entire article is: “Right now Russia and Saudi Arabia’s relationship is becoming thicker than oil,” Croft said. As for the Saudis, “I think they see themselves as trying to show the Russians they have a better friend in the Middle East (than Iran).” Here’s a quick summary: The agreement between Saudi Arabia and Russia to cut back on oil production has boosted oil prices and is now the foundation for a broader relationship. The partnership with OPEC, led by Saudi Arabia, allows Russia to strengthen its hand in the Middle East at the same time the U.S. role has been diminished. S...

Saudi Arabia among lowest oil field emissions on planet, Venezuela highest, study shows

A new study published in Nature found oil fields in Saudi Arabia had among the lowest greenhouse gas emissions on the planet, a feather in the cap of the Middle Eastern kingdom as governments worldwide combat climate change. Read Full Article Here: https://m.chron.com/business/energy/article/Saudi-Arabia-among-lowest-oil-field-emissions-on-12722769.php

How Shell hid a Whale before placing Mexican oil bet

Reuters is reporting that Royal Dutch Shell knew something that no one else did and were able to hold their cards close to their chests. It’s rumored that the gasps in the audience were clearly audible at the auction of Mexico’s oil blocks a month ago as Royal Dutch Shell’s hefty bids were announced one by one. Shell’s cash payments of $343 million, out of the total of $525 million that Mexico earned in the sale, guaranteed that the company swept up nine of the 19 offshore blocks. Six months earlier, its drilling rig had struck a giant oil reservoir, the Whale well, in the U.S. side of the Gulf of Mexico – just across the border from many of the Mexican blocks, which share a similar Paleogene-age geology. “Post the Whale discovery we had some geological insights. It is not by acc...

Chevron Says Climate Change Fallout No Quick Threat to Oil

As reported by Bloomberg, Chevron Corp.’s oil and gas business will be minimal effected by climate change for decades to come, according to a company report. Among their findings, Chevron said oil and gas will comprise 48 percent of the world’s energy mix by 2040, even under the International Energy Agency’s most unfavorable scenario for the industry. Now it’s 54 percent. While they admit that climate change is critical to future energy markets, the change has “very slim” chance of stranded assets. “Multiple scenarios” each throw up the same result: Demand for oil and gas will remain strong for decades, said Mark Nelson , Chevron’s vice president for midstream, strategy and policy said in an interview to Bloomberg. World energy demand will grow strongly under all scenarios, Che...

New warnings on liquified natural gas infrastructure

A company planning to export liquefied natural gas from the Gulf Coast will warn lawmakers this morning that surging U.S. gas production could become “stranded” absent bigger investment in pipeline and LNG infrastructure. On the record: In testimony prepared for a House Natural Resources Committee hearing today on the geopolitics of LNG, Tellurian president Meg Gentle says the government plays a key role in both laying the infrastructure groundwork for exports and offering a supportive and efficient regulatory environment… Read Full Article Here: https://www.axios.com/new-warnings-on-liquified-natural-gas-infrastructure-bbbf3665-df43-4760-93d3-8ece013bd549.html

Really!?! – IEA Says U.S. to overtake Russia as top oil producer by 2019 at latest: IEA

The United States will overtake Russia as the world’s biggest oil producer by 2019 at the latest, the International Energy Agency (IEA) said on Tuesday, as the country’s shale oil boom continues to upend global markets. This all seems to be an unbelievable turn of events. A few years ago, the rise of U.S. fracking flooded the market, and was blamed in part for the collapse and downturn. I recall reading a lot on how the Saudi’s and OPEC were going to let the downturn happen to kill off the U.S. shale industry, as it was claiming market share. Now, at $60-$65 per barrel, the industry can be profitable while the same nations that were trying to let the downturn crush the shale industry need oil closer to $100 to balance their government budgets. While this sounds great for Americans, are we ...