Crude oil

API data reportedly show a hefty weekly rise in U.S. crude supply

U.S. crude stocks rose last week as refineries boosted output, while gasoline and distillate stocks fell, data from industry group the American Petroleum Institute showed on Tuesday. Crude inventories rose by 5.3 million barrels in the week ended March 23 to 430.6 million, compared with analysts’ expectations for a decrease of 287,000 barrels. Crude stocks at the Cushing, Oklahoma, delivery hub rose by 1.7 million barrels, API said. Refinery crude runs rose by 310,000 barrels per day, API data showed. Gasoline stocks fell by 5.8 million barrels, compared with analysts’ expectations in a Reuters poll for a 2 million-barrel decline.[…] Read Full Article Here: https://www.reuters.com/article/us-global-oil/oil-drops-on-equity-weakness-surprise-api-build-idUSKBN1H3077

U.S. shale output seen hitting record 6.95 million bpd in April – EIA

U.S. crude production from major shale formations to hit a record high 6.95 million bdp in April. This is the result of an estimated rise in 131,000 barrels per day, the U.S. Energy Information Administration (EIA) said in a monthly productivity report on Monday. That expected increase would top the 105,000 bpd increase in March from the previous month to what was then expected to be a record high of 6.82 million bpd, the EIA said. The expected increase in April is largely driven by gains in oil production in the Permian and Eagle Ford formations, according to the report. With this increase the U.S. shale oil industry is increasingly being seen as a disruptive, and potentially dangerous, producer related to the global supply balance. It’s unclear on how much OPEC and Russia can cut p...

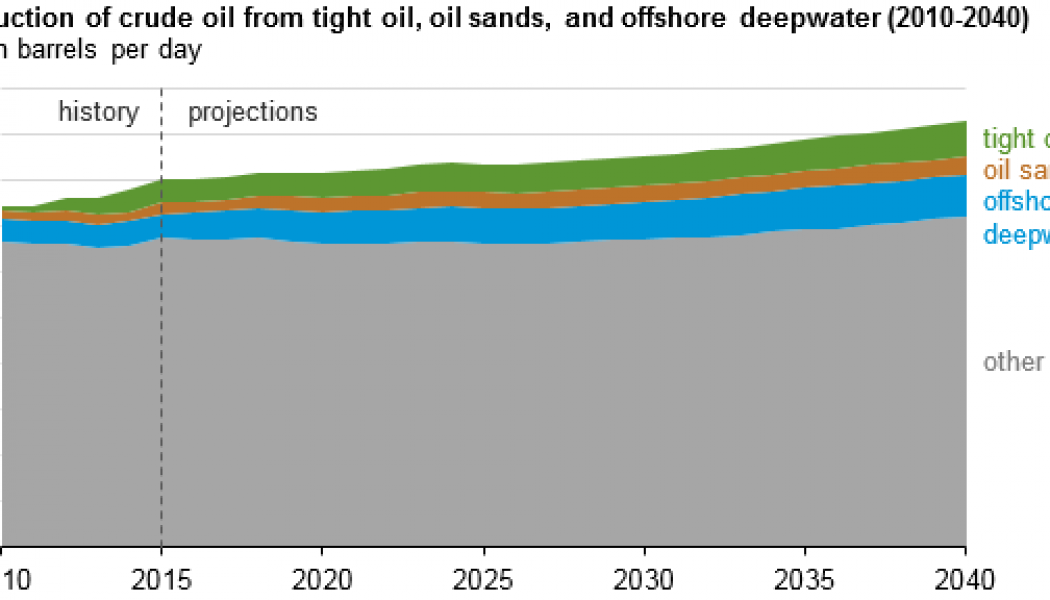

IEA Says Long Term Oil Production Growth Driven By Tight Oil, Oil Sands and Deepwater Investment

Upstream investment in crude oil and liquids production is highly sensitive to crude oil prices, particularly production of higher-cost resources from tight rock formations, oil sands, and offshore deepwater. In EIA’s International Energy Outlook 2017 (IEO2017) Reference case, increasing crude oil prices lead to more investment, driving production growth in these higher-cost resources. By 2040, EIA projects that the combined production from tight oil, oil sands, and offshore deepwater will reach 21 million barrels per day (b/d) and will account for almost a quarter of the world’s total crude oil production. From 2010 to 2014, global investment in tight oil, oil sands, and offshore deepwater development increased from 20% to 30% of total upstream investment. Over that same period, com...

Saudi oil minister hopes OPEC, allies can ease output curbs in 2019

Saudi Arabia hopes OPEC and its allies will be able to relax production curbs next year and create a permanent framework to stabilize oil markets after the current supply cut deal ends this year, its oil minister said on Saturday. The Organization of the Petroleum Exporting Countries is reducing output by about 1.2 million barrels per day (bpd) as part of a deal with Russia and other non-OPEC producers. The pact, aimed at propping oil prices, began in January 2017 and will run until the end of 2018. Read Full Article Here: https://www.cnbc.com/2018/02/24/saudi-oil-minister-hopes-opec-allies-can-ease-output-curbs-in-2019.html

Saudi Arabia Eyes Higher Oil Prices – U.S. Shale Will Play A Role

OPEC has been on a five year mission to reduce the oil glut sloshed on the global supply by the U.S. Shale production. This mission is finally in reach, Saudi Arabia wants cuts to go further to cause a small supply shortage. The underlying result would be increase oil prices. Previously content with oil at $60 a barrel, Al-Falih is now seeing $70 as the level where crude prices should trade, according to a person familiar with the matter, who asked not to be identified to Bloomberg because the information was private. With the cost of social programs and the pending IPO of Saudi Aramco, a higher oil price would be very beneficial. However, if it’s at the cost of additional market share to the U.S. Shale industry, one questions if additional cuts will have the desired results on price. “If ...

Africa’s Top Oil Producer Poised to Give OPEC an Output Headache

Add independent Nigerian drillers to the list of oil producers itching to supply more crude at a time when OPEC and allies like Russia are trying to restrict output and prop up prices. Domestic Nigerian producers are aiming to pump almost 250,000 barrels a day more crude by 2020 as part of a wider plan for the nation to lift output to 2.5 million a day, Oil Ministry data show. Shoreline Group, the third-biggest independent, wants to double output by December with Seplat Petroleum Development Co., the second-largest, also intending to produce more. (chart on original article) They are planning to add barrels at the same time as Nigeria participates in a global pact to restrict oil supply that’s being led by the Organization of Petroleum Exporting Countries and non-member nations including R...