@tomkirkman

Active 5 years, 10 months agoYou need to log in or create an account to post to this user's Wall.

-

Tom Kirkman and

Jackie Thomas are now friends 5 years, 10 months ago

Jackie Thomas are now friends 5 years, 10 months ago -

Tom Kirkman and

Saidi Foued are now friends 5 years, 10 months ago

Saidi Foued are now friends 5 years, 10 months ago -

Tom Kirkman and

Pitbull of LNG are now friends 5 years, 10 months ago

Pitbull of LNG are now friends 5 years, 10 months ago -

@tomkirkman Hi Tom, nice to be friends with you on oilconvo, it appears that you and I pop up everywhere haha.

George-

Hi George, happy to connect with you here on oilconvo. And great to bump into you online again. How you doing these days?

-

Hi Tom, likewise!

Doing OK if we could get people to change their way of thinking for exploration in Indonesia and our client would pay as well haha.

Yourself Tom?

-

We have an upcoming RFQ this month for a project in Indonesia. Can’t discuss it obviously. But if we land the project, I should be visiting Indonesia again shortly; was in Jakarta a couple months ago. Enjoy the long holiday weekend, George.

-

Sounds interesting Tom. Please let me know when you are next in Indonesia, we can catch up for a chat. Its a long, long week Tom, started last Friday.

-

Sure, it would be great to meet up with you in Indonesia. Today I’ve been coordinating discussions with USA, Singapore, Netherlands, Germany and Indonesia from over here in Malaysia, for this RFQ. Intermational O&G is fun : )

Traffic is much better this week, seems many people took the whole week off for the holiday tomorrow.

Have a great weekend!

-

-

-

Looks like I may be at the Gas expo in Jakarta on 1st to 3rd August.

-

OK Tom, I think I will be going to that, need to check with Australasia if they are present, I seem to recall they were.

-

Ok great : ) Looking forward to seeing you in Jakarta.

I’ll also be at Malaysia Oil & Gas Services Expo in Kula Lumpur on 25 – 27 September. -

Just registered for this, our media partner will not be present. Let’s arrange to meet up then Tom.

I will not be in KL although I expect our media partner will be as they live their

-

-

-

-

-

-

Tom Kirkman posted an update 6 years ago

I highly recommend reading this essay.

Well worth taking the time to read, if you are involved in international oil & gas.

Kudos to the author.

https://www.thecairoreview.com/essays/russias-new-energy-gamble/

Russia’s New Energy GambleRussia aims to position itself as a leader among energy-producing equals in Eurasia. Since 2015, Russia has sought to play a more active role in the Middle East, setting its sights on the region’s energy resources to achieve this strategic goal.

- 2 people like this.

-

Here’s a link to the map which is discussed.

“In October 2017, Rosneft Chief Executive Officer Igor Sechin took the unusual step of presenting a geopolitical report on the “ideals of Eurasian integration” to an audience in…[Read more]

-

Tom Kirkman posted an update 6 years ago

Removing the Petrobras sole operator monopoly, scaling back the excessive local content requirements, and improving transparency has worked wonders for Brazil’s oil & gas.

The latest offshore auction was a record breaking success of $2.4 billion.

==================================“Aiming to create a more competitive, market-oriented auction…[Read more]

Brazil reaps reforms rewardsEfforts to recalibrate oil concession rules to be more market-friendly and open to foreign investment are starting to bear fruit

-

Tom Kirkman and

Vijay are now friends 6 years ago

Vijay are now friends 6 years ago -

Tom Kirkman and

Javier are now friends 6 years ago

Javier are now friends 6 years ago -

Tom Kirkman posted an update 6 years ago

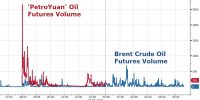

Easy to understand primer on the significance of the Petro-Yuan’s shot across the bow to the Petro-Dollar.

========================“There was a monumental event that occurred on March 26 that came and went with little fanfare but has huge implications to our everyday life. On that day, China began trading Petroyuan Futures in competition to the…[Read more]

Why the Dollar’s Era of Dominance May Be Coming to an Abrupt EndThere was a monumental event that occurred on March 26 that came and went with little fanfare but has huge implications to our everyday life. On that day, China began trading Petroyuan Futures in competition to the Petrodollar Futures. To fully understand the context of this event, it helps to go ov

-

Tom Kirkman posted an update 6 years ago

And so here is the PetroYuan’s *3rd* shot across the bow of the PetroDollar monopoly.

The first shot across the bow was the actual launching of the PetroYuan, after years of delays.

Then, less than a week after the launch of the PetroYuan, China made public its plans to pay for oil in Yuan instead of the U.S. Dollar.

Now, China is openly…[Read more]

‘Petroyuan’ to propel currency internationalization - Global TimesThe Shanghai debut of China’s first yuan-denominated crude futures trading market on Monday proved a great success, with major domestic and foreign traders displaying active interest. Total turnover amounted to 18.3 billion yuan ($2.9 billion) on the first trading day.

-

Tom Kirkman posted an update 6 years ago

Hey Western Mainstream Media… stop hyperventillating about ZOMG RUSSIA RUSSIA RUSSIA and pay attention to something significant, like the Chinese shot across the bow to the PetroDollar monopoly.

The U.S. Dollar / PetroDollar is *not* backed by gold. That may have to change eventually. Because the PetroYuan *will* be backed by physical gold.…[Read more]

The yuan-oil future and goldRegular readers of Goldmoney’s research will be aware that we were among the first to alert western financial markets that China would introduce a new oil futures contract priced in yuan, months before it was officially admitted that the plans for the contract were being finalised and a date for trading was being planned.

- 1 person likes this.

-

Tom, while you initially mentioned this would be a slow process, it feels like things are progressing much quicker over the past week. I completely understand that the transition will be slow, but the momentum behind the Petro/Yuan seems to be gaining, and with the fact it will be backed by gold, should provide additional stability.

-

Ritta, this is just the opening volley. Wait for the U.S. to pull its head out of the sand and figure out what just happened. Eventually, the U.S. will respond. Presumably with lots of bluster.

Also waiting to see how Saudi Arabia chooses to respond.

This chess game is just beginning, lots of moves still to be made.

For reference, look how…[Read more]

-

-

Tom Kirkman posted an update 6 years, 1 month ago

Western MSM should really be paying more attention to the PetroYuan. It will likely take years of many incremental steps by the Chinese government. And its global effects will likely be significant, and a game changer for the PetroDollar monopoly.

=========================“As the yuan progressively reaches full consolidation in trade…[Read more]

China taking the long road to solve the petro-yuan puzzleA number of pieces have to fall into place before the petrodollar moves into second place

-

Tom Kirkman posted an update 6 years, 1 month ago

So yesterday, China’s gold-backed PetroYuan went live.

Anyone paying attention to the impending disruption to the status quo?

This should have significant, long term repercussions.

All previous challenges to the PetroDollar monopoly were violently eliminated. Decimated.

Violent opposition against the gold-backed PetroYuan won’t happen,…[Read more]

-

Tom Kirkman posted an update 6 years, 1 month ago

Yep, I’m sounding like a broken record again, but … THE PETROYUAN HAS ARRIVED. It’s here.

The PetroYuan startup has taken years of planning. But there is now a looming, realistic (eventual) contender to the PetroDollar monopoly.

Won’t happen in a hurry. The Chinese will take small but persistent steps, much like the way they have been…[Read more]

'PetroYuan' Futures Launch With A Bang, Volume Dominates Brent As Big Traders Step In“The government (in Beijing) seems determined to support it, and I hear a number of firms are being asked or pressured to trade on it, which could help.”

- 1 person likes this.

-

Tom, curious what your thoughts are on the greater impact this has. As a global industry, and the USD still a global standard for trade, will this hurt or help certain markets.

-

It will probably disrupt international oil & gas trading, but veeeeery gradually.

I am not a fan of monopolies. It should be good for the world to have a viable alternative to the PetroDollar stranglehold.

The Chinese government tends to make deliberate, incremental steps toward their long term goals.

It could be a few years before the PetroYuan…[Read more]

-

-

Tom Kirkman posted an update 6 years, 1 month ago

The U.S. should butt out of EU energy policy.

The U.S. has no business threatening sanctions on EU companies that participate in the construction of a gas pipeline destined for distribution to the EU.

I’m a very strong supporter of oil & gas & LNG, and I fully support developing infrastructure and pipelines that support the hydrocarbon…[Read more]

US Threatens Sanctions For European Firms Participating In Russian Gas Pipeline Project"We've been clear that firm steps against the Russian energy export pipeline sector could – if they engage in that kind of business – they could expose themselves to sanctions under CAATSA."

-

Tom Kirkman and

Tamar are now friends 6 years, 1 month ago

Tamar are now friends 6 years, 1 month ago -

Tom Kirkman posted an update 6 years, 1 month ago

And so it *finally* begins … China’s slow, exceedingly deliberate and long term plan to challenge the PetroDollar monopoly with the PetroYuan.

Russia, Iran, Venezuela and a few other countries will probably cautiously climb on board.

But the key, deciding factor will be how Saudi Arabia responds.

The U.S. will of course try to sabatoge the…[Read more]

Will China’s New Oil Futures Flop? | OilPrice.comChina’s historic oil futures contract is set to launch this week, and while Beijing believes in its success, extreme price volatility could spoil the party

-

Tom Kirkman posted an update 6 years, 1 month ago

This oil field in Kuwait is pretty darn amazing. Great overview by Mike Shellman on why this particular oil field is so remarkable.

https://www.oilystuffblog.com/single-post/2018/03/20/The-Perfect-Oil-Field

-

Tom, thanks for the share. This is a great article that gives a historical lesson, and one that adds a perspective on how to view the shale revolution from a resources to production perspective. The author nailed it with the writing style too- educational, technical and also easy to read – hard to do.

-

Glad you enjoyed the article, Ritta.

The author is an old timer oil field guy inTexas, who has been blogging for 10 years or more. Mike writes good stuff.

-

-

-

Tom Kirkman posted an update 6 years, 1 month ago

I support pipelines for transporting hydrocarbons, be it oil or natural gas. Once a pipeline infrastructure is completed, it has been shown that pipelines are the safest way to transport oil.

Yes, transporting natural gas in the form of LNG is probably safer than a natural gas pipeline. But it is also much more expensive.

Nord Stream 2 should…[Read more]

Attack Against Nord Stream 2 Renewed with Vigor: Whose Interests Does It Meet?Alex GORKA: Gas exports to Europe present exciting opportunities but supplies from Russia are cheaper and more reliable. So the US needs to get rid of the obstacle in its way — the Nord Stream 2 (NS2) pipeline, which will carry natural gas from Russia to Germany. Washington will do anything to achieve this cherished goal.

-

Tom Kirkman posted an update 6 years, 1 month ago

While it is not at all surprising that Saudi Arabia has pretty much decided not to take their Aramco IPO to New York, London, or Hong Kong, it *is* surprising to me that they may offer the IPO on their own fledgling, domestic Saudi Arabia stock exchange.

I’ve been guestimating that KSA and MbS may take the IPO offer to state players such as China…[Read more]

Aramco Kills Massive Offshore IPO, Will Only Offer Shares DomesticallyAramco has nixed plans to list shares in either the US, UK or Hong Kong - and will instead restrict its IPO to the domestic market...

-

I was under the impression that half of the Saudi population receives social welfare backed by the oil industry – if this is false please correct. So, isn’t this a little like going IPO an buying the shares with your own money?

What is the benefit to Aramco with this move?

-

You are correct about the social welfare.

So far, near as I can tell, MbS (the crown prince) got spooked by the full disclosures that would be required by listing on NY and London stock exchanges, and state players don’t seem to be eager to snap up shares. China in particular appears standoffish.

Perhaps MbS plans to have the IPO on the Saudi…[Read more]

-

-

- Load More