Production

U.S. shale output seen hitting record 6.95 million bpd in April – EIA

U.S. crude production from major shale formations to hit a record high 6.95 million bdp in April. This is the result of an estimated rise in 131,000 barrels per day, the U.S. Energy Information Administration (EIA) said in a monthly productivity report on Monday. That expected increase would top the 105,000 bpd increase in March from the previous month to what was then expected to be a record high of 6.82 million bpd, the EIA said. The expected increase in April is largely driven by gains in oil production in the Permian and Eagle Ford formations, according to the report. With this increase the U.S. shale oil industry is increasingly being seen as a disruptive, and potentially dangerous, producer related to the global supply balance. It’s unclear on how much OPEC and Russia can cut p...

Another headache for OPEC: Old fields find new life

Bob Dudley, in his 38 years in the oil industry, has never seen anything like what happened with BP Plc’s old fields last year: They gushed more crude. “I cannot remember ever in my career having seen a negative decline rate,” the British oil-giant’s chief executive officer said in an interview on the sidelines of the CERAWeek by IHS Markit energy conference in Houston. Dudley isn’t alone in seeing mature fields dwindling less than expected –in BP’s case surprisingly increasing — giving the OPEC one more thing to worry about. As if the shale boom wasn’t enough of a headache. Better results from legacy fields, also observed by producers like Royal Dutch Shell Plc and countries like Norway, further complicate efforts by petro-states like ...

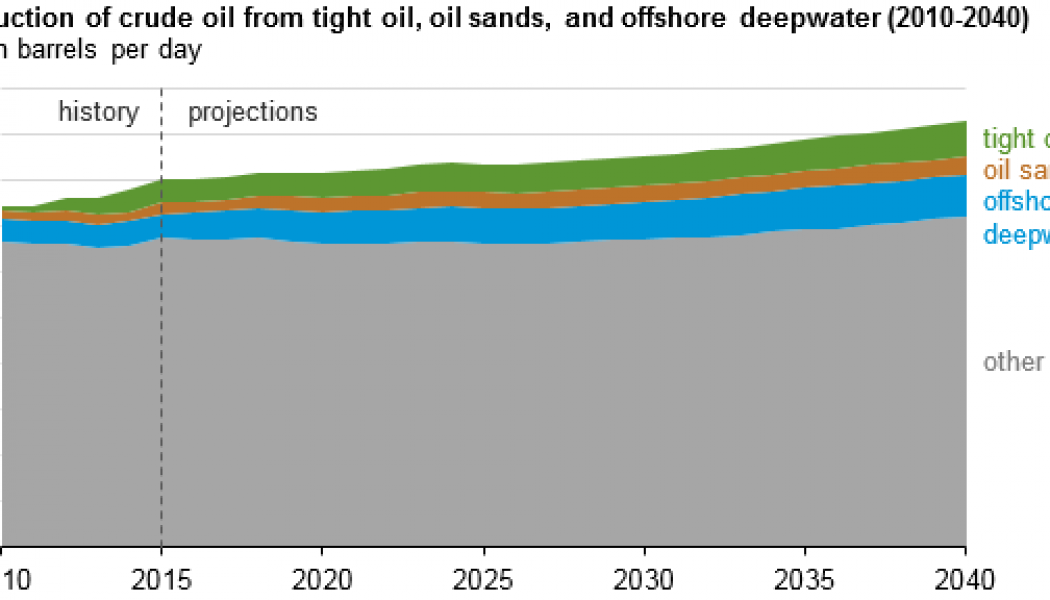

IEA Says Long Term Oil Production Growth Driven By Tight Oil, Oil Sands and Deepwater Investment

Upstream investment in crude oil and liquids production is highly sensitive to crude oil prices, particularly production of higher-cost resources from tight rock formations, oil sands, and offshore deepwater. In EIA’s International Energy Outlook 2017 (IEO2017) Reference case, increasing crude oil prices lead to more investment, driving production growth in these higher-cost resources. By 2040, EIA projects that the combined production from tight oil, oil sands, and offshore deepwater will reach 21 million barrels per day (b/d) and will account for almost a quarter of the world’s total crude oil production. From 2010 to 2014, global investment in tight oil, oil sands, and offshore deepwater development increased from 20% to 30% of total upstream investment. Over that same period, com...

Really!?! – IEA Says U.S. to overtake Russia as top oil producer by 2019 at latest: IEA

The United States will overtake Russia as the world’s biggest oil producer by 2019 at the latest, the International Energy Agency (IEA) said on Tuesday, as the country’s shale oil boom continues to upend global markets. This all seems to be an unbelievable turn of events. A few years ago, the rise of U.S. fracking flooded the market, and was blamed in part for the collapse and downturn. I recall reading a lot on how the Saudi’s and OPEC were going to let the downturn happen to kill off the U.S. shale industry, as it was claiming market share. Now, at $60-$65 per barrel, the industry can be profitable while the same nations that were trying to let the downturn crush the shale industry need oil closer to $100 to balance their government budgets. While this sounds great for Americans, are we ...

Saudi oil minister hopes OPEC, allies can ease output curbs in 2019

Saudi Arabia hopes OPEC and its allies will be able to relax production curbs next year and create a permanent framework to stabilize oil markets after the current supply cut deal ends this year, its oil minister said on Saturday. The Organization of the Petroleum Exporting Countries is reducing output by about 1.2 million barrels per day (bpd) as part of a deal with Russia and other non-OPEC producers. The pact, aimed at propping oil prices, began in January 2017 and will run until the end of 2018. Read Full Article Here: https://www.cnbc.com/2018/02/24/saudi-oil-minister-hopes-opec-allies-can-ease-output-curbs-in-2019.html

Peak U.S. Shale Could Be 4 Years Away

As reported by Oilprice.com, The United States Energy Information Administration is predicting that shale oil is set to peak in the next four years U.S. shale production growth has outperformed even the most bullish forecasts, forcing OPEC and the International Energy Agency (IEA) to revise up American supply growth projections month after month. The U.S. Energy Information Administration (EIA) also expects shale/tight oil to continue to grow in all possible modeled scenarios for the next four years, according to its Annual Energy Outlook 2018 published this month. The article shares many of the EIA statistics from their report, but there is a warning on the horizon, that shale growth will widely be determined by investor confidence and market conditions. The drive to profitability and cas...

Fracking Has Its Costs And Benefits — The Trick Is Balancing Them

Thanks to fracking, U.S. production of oil and natural gas has surged, lowering energy prices and reducing emissions. But as communities grapple with whether to allow fracking, it is vital that they have all the facts on its impacts to ensure that we get fracking’s benefits and minimize its costs. Read Full Article Here: https://www.forbes.com/sites/ucenergy/2018/02/20/fracking-has-its-costs-and-benefits-the-trick-is-balancing-them/#36f6ff9a19b4

Clean Oil That Only Costs $20

As the shale revolution is reaching its limits, the U.S. oil patch might have found a new way to significantly boost oil production… Read Full Article Here: https://oilprice.com/Energy/Oil-Prices/Clean-Oil-That-Only-Costs-20.html

Oil Producers Buying Back Shares After Years of Selling New Stock

The Wall Street Journal reported that energy companies are turning their focus to shareholder returns amid higher oil prices and asset sales. This is triggering a stock buy back wave from some of the largest producers. As WSJ framed the story, many North American energy producers survived the recent oil bust in large part by selling more than $60 billion of new stock and now they’re beginning to buy it back. Some companies mentioned Pioneer Natural Resources Co. and Anadarko Petroleum Corp., have started the year by initiating or enlarging share-repurchase programs, with others joining this trend. The buyback is another sign that the recovery is stable and in full force. Oil prices have climbed high enough for these producers to drill profitably and shareholders are urging and demanding th...

U.S. oil production booms as new year begins

Shale oil drilling has erased memories of long gas lines in the 1970s. U.S. crude oil production is flirting with record highs heading into the new year, thanks to the technological nimbleness of shale oil drillers . The current abundance has erased memories of 1973 gas lines, which raised pump prices dramatically, traumatizing the United States and reordering its economy. In the decades since, presidents and politicians have made pronouncements calling for U.S. energy independence. President Jimmy Carter in a televised speech compared the energy crisis of 1977 to “the moral equivalent of war.”… Read Full Article Here: https://www.washingtonpost.com/business/capitalbusiness/us-oil-production-booms-as-new-year-begins/2017/12/31/de49b50e-ee50-11e7-b3bf-ab90a706e175_story.html

DUG Eagle Ford: Marathon Oil Leverages The Digital Oil Field

The company’s technology director discussed how digital technology and innovation acts as a competitive differentiator. Marathon has adopted video surveillance, real-time notifications and decision-making capabilities to its field operations. Suarez noted that once those new process improvements were added to the company’s control center, it was able to introduce a safer and more efficient way of operating. “Thanks to the digital oil field enhancements in our Eagle Ford assets we’re adding two to three barrels of production to every well per day, which could ultimately result in several thousands of additional barrels annually at virtually zero cost,” Suarez said. Read Full Article Here: https://www.ugcenter.com/dug-eagle-ford-marathon-oil-leverages-digital-oil-field-1671186

America’s oil and gas output could soar 25% by 2025

http://money.cnn.com/2017/11/14/news/economy/us-oil-gas-shale-iea/index.html The United States is on track to pump 30 million barrels of oil and gas a day by 2025, 50% more than any other country has ever managed. The dramatic shifts envisioned by the IEA in its World Energy Outlook would transform the U.S. from an energy importer into a major player in global markets capable of producing 30 million barrels of oil and gas a day by 2025. Paris-based IEA predicts that U.S. shale oil producers will boost their output by 8 million barrels a day between 2010 and 2025…