Shale

As shale wells grow longer, buyouts attract hemmed in oil producers

A recent drought in oil company mergers and acquisitions could be coming to an end over a new Texas range war: U.S. shale producers are building miles-long horizontal wells that are running into their rivals’ land holdings. Read Full Article Here: https://www.reuters.com/article/us-usa-oil-permian/as-shale-wells-grow-longer-buyouts-attract-hemmed-in-oil-producers-idUSKBN1H61FW

US shale pumping will see oil prices slide back to $50, JP Morgan analyst predicts

Efficiency improvements from the world’s largest oil-producing firms and countries, alongside the rise of U.S. shale, will see prices slide back to near $50 a barrel, according to research at investment bank J.P. Morgan. Christian Malek, the head of EMEA oil and gas equity research at J.P. Morgan, said that the “breakeven” price — where they just about manage to cover their costs — for OPEC nations and major energy companies would drift back towards $50 a barrel by the end of next year. He explained this current price was in the mid-$60 a barrel price range, including for nations like Saudi Arabia, Iraq and Kuwait. However, the bank predicted a “breakeven duel” between the 14-member OPEC organization and big oil companies would soon “drive a vicious cycl...

Asset Sales Accelerate In The Oil & Gas Industry

Now that oil prices have solidified above per barrel, companies are beginning to shed more valuable assets to pay down debt and fund their more profitable plays. Read Full Article Here: https://www.forbes.com/sites/clairepoole/2018/03/20/asset-sales-accelerate-in-the-oil-gas-industry/#362fdaf91aee

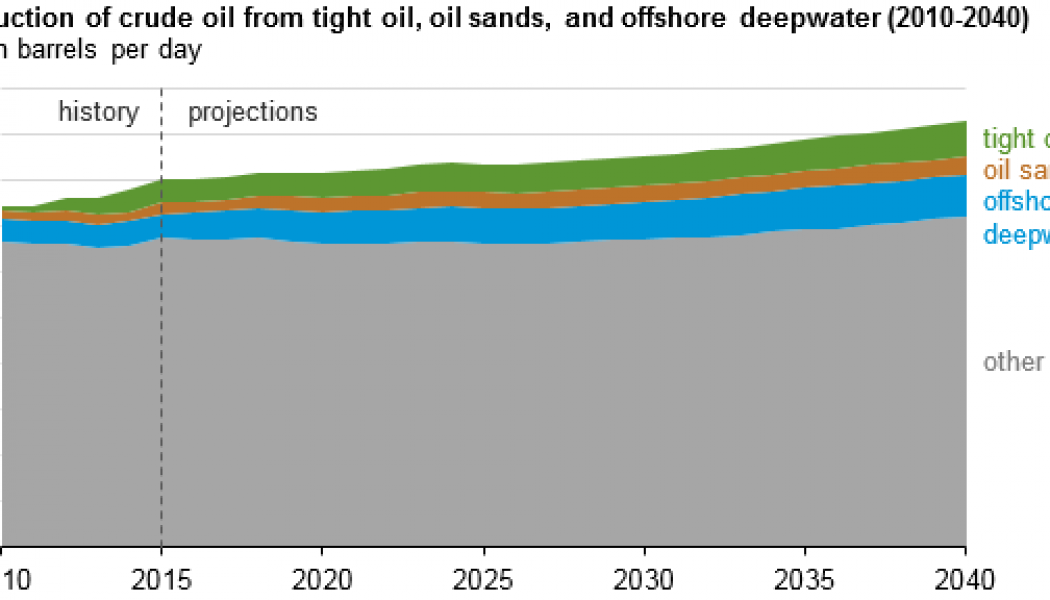

IEA Says Long Term Oil Production Growth Driven By Tight Oil, Oil Sands and Deepwater Investment

Upstream investment in crude oil and liquids production is highly sensitive to crude oil prices, particularly production of higher-cost resources from tight rock formations, oil sands, and offshore deepwater. In EIA’s International Energy Outlook 2017 (IEO2017) Reference case, increasing crude oil prices lead to more investment, driving production growth in these higher-cost resources. By 2040, EIA projects that the combined production from tight oil, oil sands, and offshore deepwater will reach 21 million barrels per day (b/d) and will account for almost a quarter of the world’s total crude oil production. From 2010 to 2014, global investment in tight oil, oil sands, and offshore deepwater development increased from 20% to 30% of total upstream investment. Over that same period, com...

OPEC wants to talk with rival US shale drillers to learn lessons of downturn

OPEC wants an open dialogue with U.S. shale drillers after the most painful downturn in six oil price cycles. OPEC was meeting with rival U.S. shale producers on the sidelines of the annual CERAWeek energy conference for a second year in a row, in an effort to learn what the industry can do to avoid the type of painful downturn faced in 2015. Read Full Article Here: https://www.cnbc.com/2018/03/05/opec-wants-to-talk-with-rival-u-s-shale-drillers-to-learn-lessons-of-downturn.html

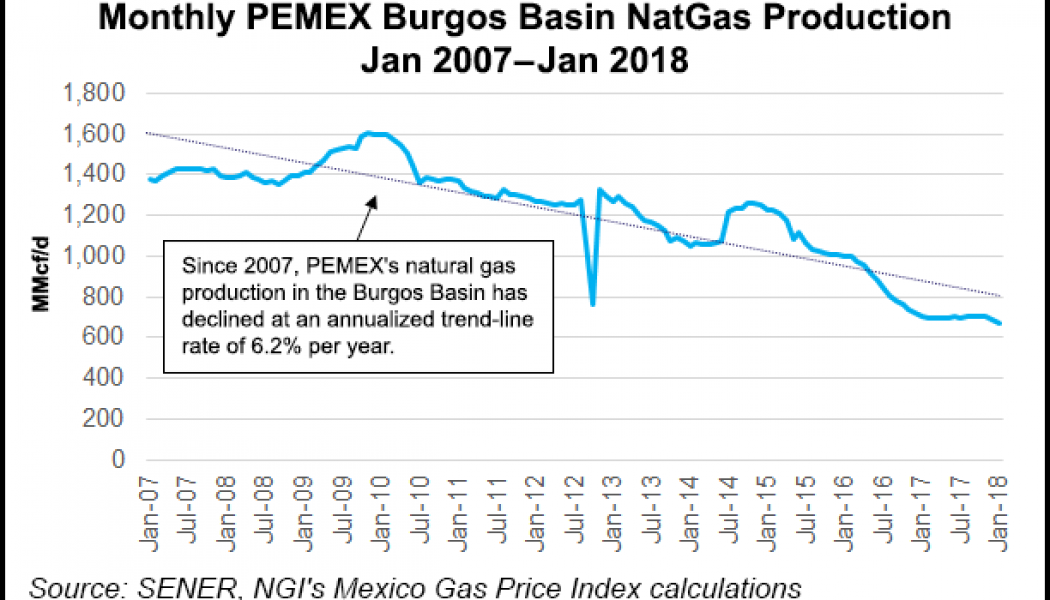

Mexico Ramps Up for Historic Round 3.3 Unconventionals Auction

Mexico’s energy authorities have taken a bold initiative by inviting tenders for the nation’s first auction of unconventional resources of massive but thus far unrealized potential and fraught with potential problems. Read Full Article Here: http://www.naturalgasintel.com/articles/113575-mexico-ramps-up-for-historic-round-33-unconventionals-auction

Peak U.S. Shale Could Be 4 Years Away

As reported by Oilprice.com, The United States Energy Information Administration is predicting that shale oil is set to peak in the next four years U.S. shale production growth has outperformed even the most bullish forecasts, forcing OPEC and the International Energy Agency (IEA) to revise up American supply growth projections month after month. The U.S. Energy Information Administration (EIA) also expects shale/tight oil to continue to grow in all possible modeled scenarios for the next four years, according to its Annual Energy Outlook 2018 published this month. The article shares many of the EIA statistics from their report, but there is a warning on the horizon, that shale growth will widely be determined by investor confidence and market conditions. The drive to profitability and cas...

US shale investors still waiting on payoff from oil boom

U.S. oil production has topped 10 million barrels per day, approaching a record set in 1970, but many investors in the companies driving the shale oil revolution are still waiting for their payday. Shale producers have raised and spent billions of dollars to produce more oil and gas, ending decades of declining output and redrawing the global energy trade map. But most U.S. shale producers have failed for years to turn a profit with the increased output, frustrating their financial backers. Wall Street’s patience ran out late last year as investors called for producers to shift more cash to dividends and share buybacks… Read Full Article Here: https://www.cnbc.com/2018/02/23/us-shale-investors-still-waiting-on-payoff-from-oil-boom.html

Earthquakes in southern Kansas linked to oil, gas production

Research suggests activity tied to hydraulic fracturing by the oil and gas industry explains the large increases in earthquakes in southern Kansas. The link to the full article is below. The two parts that got me thinking that I wanted to share were: “While researchers say the earthquakes are not linked specifically to hydraulic fracturing, wastewater injection — an activity that follows fracturing — may be linked to them. When scientists compared the timeline of seismic activity with the schedule of wastewater injection, they found a strong correlation between the two. Their data showed an increased in wastewater injection and seismic activity was followed by a decrease in both in 2015. A drop in oil and gas prices, combined with new regulations designed to limit wastewa...

Fracking Has Its Costs And Benefits — The Trick Is Balancing Them

Thanks to fracking, U.S. production of oil and natural gas has surged, lowering energy prices and reducing emissions. But as communities grapple with whether to allow fracking, it is vital that they have all the facts on its impacts to ensure that we get fracking’s benefits and minimize its costs. Read Full Article Here: https://www.forbes.com/sites/ucenergy/2018/02/20/fracking-has-its-costs-and-benefits-the-trick-is-balancing-them/#36f6ff9a19b4

Clean Oil That Only Costs $20

As the shale revolution is reaching its limits, the U.S. oil patch might have found a new way to significantly boost oil production… Read Full Article Here: https://oilprice.com/Energy/Oil-Prices/Clean-Oil-That-Only-Costs-20.html

Why Canada is the next frontier for shale oil

The revolution in U.S. shale oil has battered Canada’s energy industry in recent years, ending two decades of rapid expansion and job creation in the nation’s vast oil sands. Now Canada is looking to its own shale fields to repair the economic damage. Canadian producers and global oil majors are increasingly exploring the Duvernay and Montney formations, which they say could rival the most prolific U.S. shale fields. Canada is the first country outside the United States to see large-scale development of shale resources, which already account for 8 percent of total Canadian oil output. China, Russia and Argentina also have ample shale reserves but have yet to overcome the obstacles to full commercial development… Read Full Article Here: https://...

- 1

- 2