Markets

The 7 reasons behind U.S. oil’s sharpest daily point drop in almost 3 years

The biggest weekly drop in U.S. crude supplies couldn’t halt the drop in oil prices Wednesday as traders chose to focus on expectations for higher global output. Read Full Article Here: https://www.marketwatch.com/story/the-7-reasons-behind-us-oils-sharpest-daily-point-drop-in-almost-3-years-2018-07-11

Oil hits $75 for first time since 2014 on supply outages in Libya and Canada

Oil prices rose on Tuesday after Libya declared force majeure on some of its crude exports, while the loss of Canadian supplies helped lifted U.S. crude to levels not seen since late 2014. Read Full Article Here: https://www.cnbc.com/amp/2018/07/03/oil-libya-declares-force-majeure-on-supplies-demand-slowdown-looms.html

Oil surges 3.6%, settling at $70.53, after US says crude buyers must cut Iran imports to zero

Crude prices surged by more than 3 percent on Tuesday after the U.S. State Department said it will require companies to cut all oil imports from Iran to zero by November. The announcement exacerbates concerns about a shortage of oil at a time when Venezuela’s production is in terminal decline and the market is grappling with short-term supply disruptions from Canada and Libya. Last week, OPEC and other producers including Russia agreed to raise output to prevent price spikes. U.S. West Texas Intermediate crude futures ended Tuesday’s session up $2.45 a barrel, or 3.6 percent, to $70.53, erasing earlier losses and breaking above $70 for the first time since May 25. International benchmark Brent crude was up $1.60, or 2.1 percent, at $76.33 per barrel by 2:29 pm. ET. [,…] Read Full Article H...

Here’s what could happen to oil if everyone’s OPEC expectations are wrong

June has been a crazy month for market-moving global events, and the tail end of this week is shaping up the same way, if OPEC succeeds in shaking up the status quo. The next 24 to 48 hours could turn into a “headline-driven-free-for-all, so buckle in,” is the sage advice from OANDA’s head of trading, Stephen Innes. He’s referring to this week’s three-day OPEC summit, which ends Saturday […] Read Full Article Here: https://www.marketwatch.com/story/heres-what-happens-to-oil-if-everyones-opec-expectations-are-wrong-2018-06-21

The party may end soon: Economists predict a recession by 2020

The skies of the U.S. economy are clear and sunny, but many analysts see storm clouds on the horizon. By many measures, the economy is in its best shape since the Great Recession of 2007 to 2009. Employment hit an 18-year low of 3.8% in May. Average wage growth is widely expected to reach 3% by the end of the year. And the economy is projected to grow nearly 3% in 2018 for just the second time since the downturn. Yet the economic expansion is the second-longest in U.S. history, leading many economists to forecast a recession as early as next year. Half the economists surveyed last month by the National Association of Business Economics foresee a recession starting in late 2019 or in early 2020, and two-thirds are predicting a slump by the end of 2020. […] Read Full Article Here: http...

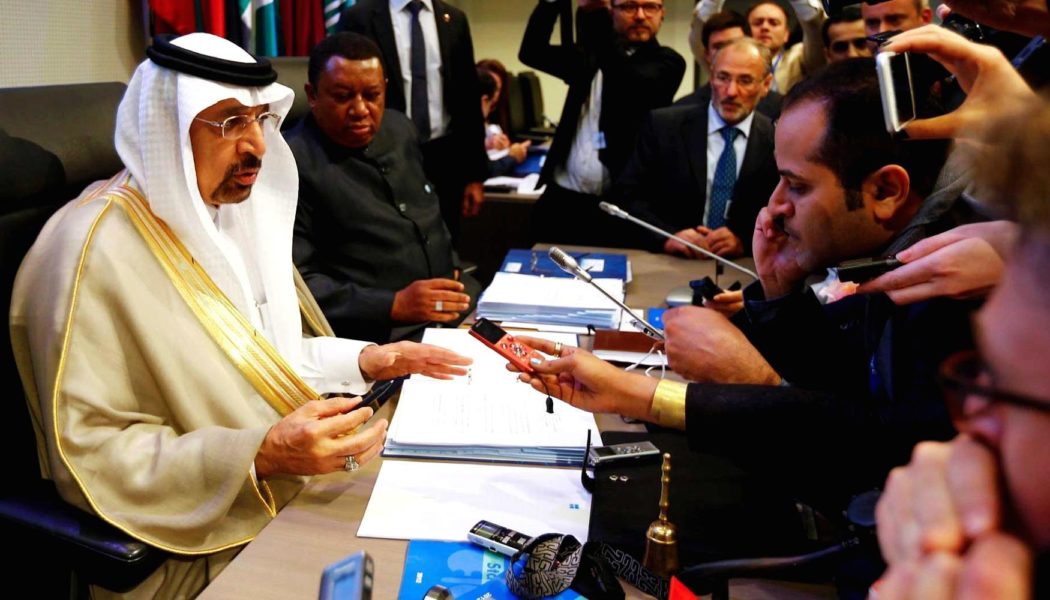

OPEC meeting ‘might be one of the worst since 2011’ amid differences over supply

The forthcoming meeting between OPEC and non-OPEC oil producers, including Russia, could be one of the most fractious in recent years with competing interests and demands at play, according to oil market experts. OPEC’s production policy will dominate the agenda when the world’s major oil producers meet in Vienna on June 22, with arguments expected over whether to increase production or maintain supply as it is. Saudi Arabia and Russia are reportedly ready to increase oil output while others like Iran and Iraq are against such a move. As such, the discussions might not be pretty, […] Read Full Article Here: https://www.cnbc.com/2018/06/07/opec-meeting-on-june-22-likely-to-see-disagreements.html

The ‘biggest’ change in oil market history: A shipping revolution could prompt crude prices to soar

The most prominent driver of oil prices over the next two years is likely to come in the shape of a shipping revolution, analysts have warned. Read Full Article Here: https://www.cnbc.com/2018/05/24/oil-prices-set-to-soar-ahead-of-shipping-revolution.html

Oil prices have come full circle since OPEC refused to cut output 3½ years ago

Brent crude is trading at the highest levels since Nov. 25, 2014, just before an OPEC meeting that tanked the market. Read Full Article Here: https://www.cnbc.com/2018/05/15/oil-prices-have-rebounded-since-opec-refused-to-cut-output-in-2014.html

Citi warns that surging oil prices could soon create a ‘hostile environment’ for stocks

A dramatic upswing in oil prices over recent months could soon create a “particularly hostile environment” for global investors, Citi economists warned Monday. The price of crude has risen over the past two years, from $26 in 2016 to $77 on Monday, as the balance between supply and demand has been steadily tightening. This has helped boost company’s profits too— with several oil and gas producers and refiners among the biggest gainers on Wall Street over the past month. […] Read Full Article Here: https://www.cnbc.com/2018/05/14/citi-warns-surging-oil-prices-could-create-hostile-environment-for-stocks.html

All the reasons crude oil might go back to $100 a barrel

here is a risk that oil prices could hit $100 per barrel next year for the first time since 2014, according to new research from Bank of America Merrill Lynch. It’s primarily an old-fashioned case of more demand, less supply. In an interview with Bloomberg, BofAML’s head of commodities research Francisco Blanch discusses the important dynamics driving the oil markets […] Read Full Article Here: https://qz.com/1275211/all-the-reasons-crude-oil-might-go-back-to-100-a-barrel/

How Oil And Gas Companies Can Thrive In A Shallower Profit Pool

My computer graphics on people and natural resources. Buoyancy has returned to the oil and gas industry as prices stabilize in the $50 to $70 range. Capital spending is rebounding and new upstream projects launch weekly. In previous cycles, this is about the point where executives forgot the hard-won lessons of the downturn and began to spend again, pursing growth at the cost of efficiency. This time, however, a return to old habits could prove an existential mistake. Our analysis finds that fierce competition, technological disruption and regulatory complexity have combined to reduce the profit pool by more than 60%—difficult math that should force oil and gas executives to keep the pressure on their efforts to reduce costs and improve efficiency (see figure)[…] Read Full Article Here: ht...

Bullish investors have a lock on the oil market, putting $100 a barrel in play, market veteran says

Oil expert Tom Kloza’s bearish days are behind him. Kloza, who’s known for calling the 2015 crude collapse, isn’t ruling out triple digit a barrel oil this year. “Anything that’s between $70 and $100 [a barrel] right now doesn’t represent hyperbole,” he said recently on CNBC’s “Futures Now.” The veteran oil market watcher added: “The bulls aren’t just in charge, they’ve got a hammerlock on this market.” […] Read Full Article Here: https://www.cnbc.com/2018/05/13/oil-could-hit-100-a-barrel-tom-kloza-says.html