Upstream

China becomes world’s No.2 LNG importer in 2017, behind Japan

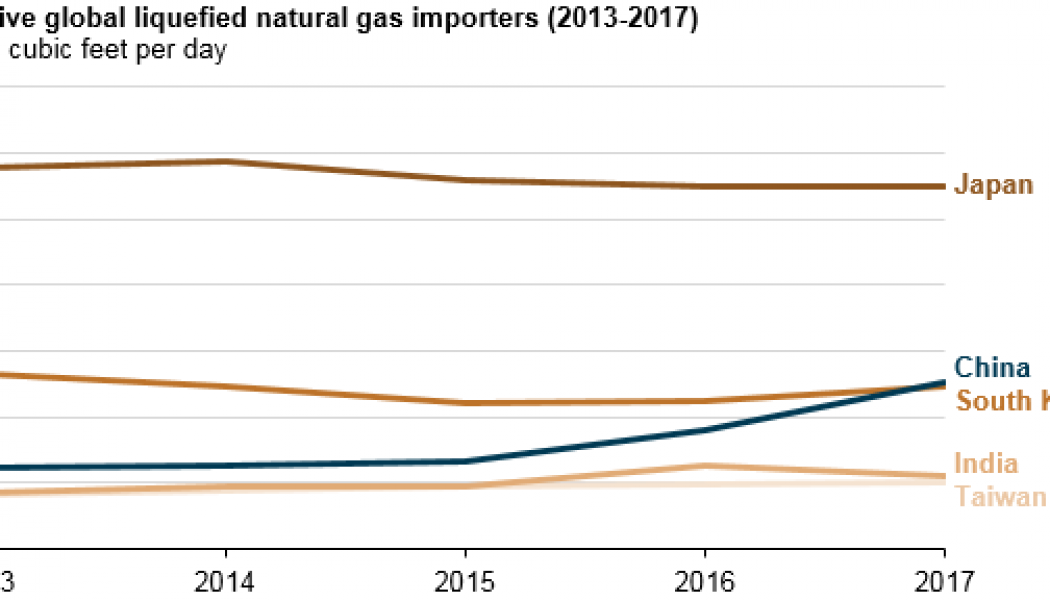

Last week the EIA reported that China will become the second largest LNG importer in the world, behind Japan. Several outlets have written about this growth and what it means to the industry as a whole. The report states that China surpassed South Korea to become the world’s second-largest importer of liquefied natural gas (LNG) in 2017, according to data from IHS Markit and official Chinese government statistics. Chinese imports of LNG averaged 5 billion cubic feet per day (Bcf/d) in 2017, exceeded only by Japanese imports of 11 Bcf/d. Imports of LNG by China, driven by government policies designed to reduce air pollution, increased by 1.6 Bcf/d (46%) in 2017, with monthly imports reaching 7.8 Bcf/d in December. China’s imports of natural gas have grown to meet increasing domestic ...

Saudi oil minister hopes OPEC, allies can ease output curbs in 2019

Saudi Arabia hopes OPEC and its allies will be able to relax production curbs next year and create a permanent framework to stabilize oil markets after the current supply cut deal ends this year, its oil minister said on Saturday. The Organization of the Petroleum Exporting Countries is reducing output by about 1.2 million barrels per day (bpd) as part of a deal with Russia and other non-OPEC producers. The pact, aimed at propping oil prices, began in January 2017 and will run until the end of 2018. Read Full Article Here: https://www.cnbc.com/2018/02/24/saudi-oil-minister-hopes-opec-allies-can-ease-output-curbs-in-2019.html

Peak U.S. Shale Could Be 4 Years Away

As reported by Oilprice.com, The United States Energy Information Administration is predicting that shale oil is set to peak in the next four years U.S. shale production growth has outperformed even the most bullish forecasts, forcing OPEC and the International Energy Agency (IEA) to revise up American supply growth projections month after month. The U.S. Energy Information Administration (EIA) also expects shale/tight oil to continue to grow in all possible modeled scenarios for the next four years, according to its Annual Energy Outlook 2018 published this month. The article shares many of the EIA statistics from their report, but there is a warning on the horizon, that shale growth will widely be determined by investor confidence and market conditions. The drive to profitability and cas...

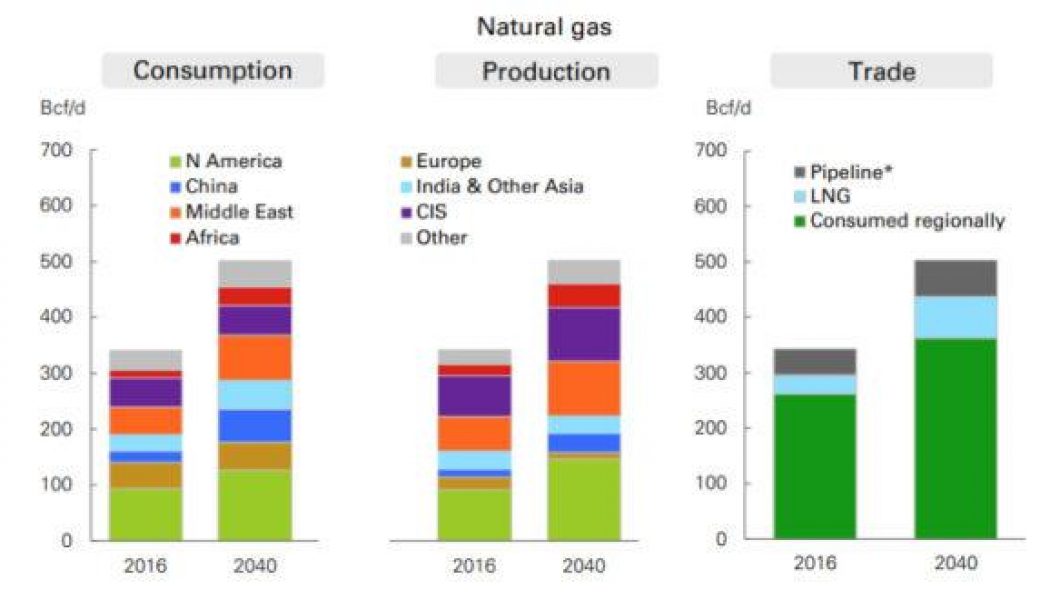

BP Energy Outlook: U.S. to ‘Dominate’ Global Oil and Gas Production

BP’s recently released Energy Outlook 2018 projects that the United States will continue to expand its position as the world’s largest producer of oil and natural gas through 2040. In addition to establishing a commanding lead in global oil production, which includes crude and natural gas liquids, between now and 2040, BP expects the U.S. will account for nearly a quarter of global natural gas production by 2040. Such impressive production levels are driven by the use of hydraulic fracturing, as the technology has unlocked massive reserves of tight oil and natural gas from shale regions across the country. Read Full Article Here: https://energyindepth.org/national/bp-energy-outlook-u-s-dominate-global-oil-gas-production/

US shale investors still waiting on payoff from oil boom

U.S. oil production has topped 10 million barrels per day, approaching a record set in 1970, but many investors in the companies driving the shale oil revolution are still waiting for their payday. Shale producers have raised and spent billions of dollars to produce more oil and gas, ending decades of declining output and redrawing the global energy trade map. But most U.S. shale producers have failed for years to turn a profit with the increased output, frustrating their financial backers. Wall Street’s patience ran out late last year as investors called for producers to shift more cash to dividends and share buybacks… Read Full Article Here: https://www.cnbc.com/2018/02/23/us-shale-investors-still-waiting-on-payoff-from-oil-boom.html

Earthquakes in southern Kansas linked to oil, gas production

Research suggests activity tied to hydraulic fracturing by the oil and gas industry explains the large increases in earthquakes in southern Kansas. The link to the full article is below. The two parts that got me thinking that I wanted to share were: “While researchers say the earthquakes are not linked specifically to hydraulic fracturing, wastewater injection — an activity that follows fracturing — may be linked to them. When scientists compared the timeline of seismic activity with the schedule of wastewater injection, they found a strong correlation between the two. Their data showed an increased in wastewater injection and seismic activity was followed by a decrease in both in 2015. A drop in oil and gas prices, combined with new regulations designed to limit wastewa...

“Gooooal” for Egypt and Israel Gas Deal

Egypt’s president says his country “scored a goal” by signing a billion deal with an Israeli company to supply natural gas that will help turn Egypt into a regional energy hub. The deal is worth 15 billion and will help establish Egypt as a regional energy hub. As reported by Fox Business, the agreement signed Monday was between Delek Drilling and its U.S. partner, Noble Energy and covers 64 billion cubic meters of gas over a 10-year period. The project is expected to be in full swing next year. The gas will be delivered from Israel’s Tamar gas field, which is already operational, and the larger “Leviathan” field, which is set to go online in late 2019. As the region continues to recover from recent sabotage from ISIS, there will likely be additional dea...

Fracking Has Its Costs And Benefits — The Trick Is Balancing Them

Thanks to fracking, U.S. production of oil and natural gas has surged, lowering energy prices and reducing emissions. But as communities grapple with whether to allow fracking, it is vital that they have all the facts on its impacts to ensure that we get fracking’s benefits and minimize its costs. Read Full Article Here: https://www.forbes.com/sites/ucenergy/2018/02/20/fracking-has-its-costs-and-benefits-the-trick-is-balancing-them/#36f6ff9a19b4

Clean Oil That Only Costs $20

As the shale revolution is reaching its limits, the U.S. oil patch might have found a new way to significantly boost oil production… Read Full Article Here: https://oilprice.com/Energy/Oil-Prices/Clean-Oil-That-Only-Costs-20.html

Oil Producers Buying Back Shares After Years of Selling New Stock

The Wall Street Journal reported that energy companies are turning their focus to shareholder returns amid higher oil prices and asset sales. This is triggering a stock buy back wave from some of the largest producers. As WSJ framed the story, many North American energy producers survived the recent oil bust in large part by selling more than $60 billion of new stock and now they’re beginning to buy it back. Some companies mentioned Pioneer Natural Resources Co. and Anadarko Petroleum Corp., have started the year by initiating or enlarging share-repurchase programs, with others joining this trend. The buyback is another sign that the recovery is stable and in full force. Oil prices have climbed high enough for these producers to drill profitably and shareholders are urging and demanding th...

Saudi Arabia Eyes Higher Oil Prices – U.S. Shale Will Play A Role

OPEC has been on a five year mission to reduce the oil glut sloshed on the global supply by the U.S. Shale production. This mission is finally in reach, Saudi Arabia wants cuts to go further to cause a small supply shortage. The underlying result would be increase oil prices. Previously content with oil at $60 a barrel, Al-Falih is now seeing $70 as the level where crude prices should trade, according to a person familiar with the matter, who asked not to be identified to Bloomberg because the information was private. With the cost of social programs and the pending IPO of Saudi Aramco, a higher oil price would be very beneficial. However, if it’s at the cost of additional market share to the U.S. Shale industry, one questions if additional cuts will have the desired results on price. “If ...

ExxonMobile announces high-quality, hydrocarbon-bearing reservoirs from P’nyang South-2 well

ExxonMobil Corp. late Monday, January 15, announced that it encountered hydrocarbons after drilling the onshore P’nyang South-2 well, located in the Western Province of Papua New Guinea. “We are currently evaluating the well results and together with our co-venture partners will assess the P’nyang field resource potential and development pathway,” Liam Mallon, president of ExxonMobil Develop Co., said in a written statement. “We will work with the government of Papua New Guinea as we undertake this work.” According to ExxonMobil, Oil Search began drilling the P’nyang South-2 well on Oct. 22, 2017. The well is located in petroleum retention license 3, which covers 105,000 acres (425 square kilometers). The well was safely drilled to 8,940 feet (2,725 meters), reaching high-quality, hydrocar...