-

Tom Kirkman posted an update 6 years, 1 month ago

Yep, I’m sounding like a broken record again, but … THE PETROYUAN HAS ARRIVED. It’s here.

The PetroYuan startup has taken years of planning. But there is now a looming, realistic (eventual) contender to the PetroDollar monopoly.

Won’t happen in a hurry. The Chinese will take small but persistent steps, much like the way they have been increasingly securing their overarching claims to pretty much the entirety of the South China Sea.

As a reminder, my view is that monopolies are never good in the long run. Let’s see how the PetroYuan disrupts WTI and Brent pricing in the near future.

=========================After numerous “false starts” over the last decade, the “petroyuan” is now real and China will set out to challenge the “petrodollar” for dominance.

Adam Levinson, managing partner and chief investment officer at hedge fund manager Graticule Asset Management Asia (GAMA), already warned last year that China launching a yuan-denominated oil futures contract will shock those investors who have not been paying attention.

https://www.zerohedge.com/news/2018-03-26/petroyuan-futures-volume-dominates-brent-big-traders-step

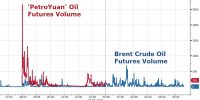

'PetroYuan' Futures Launch With A Bang, Volume Dominates Brent As Big Traders Step In“The government (in Beijing) seems determined to support it, and I hear a number of firms are being asked or pressured to trade on it, which could help.”

Tom, curious what your thoughts are on the greater impact this has. As a global industry, and the USD still a global standard for trade, will this hurt or help certain markets.

It will probably disrupt international oil & gas trading, but veeeeery gradually.

I am not a fan of monopolies. It should be good for the world to have a viable alternative to the PetroDollar stranglehold.

The Chinese government tends to make deliberate, incremental steps toward their long term goals.

It could be a few years before the PetroYuan becomes a viable alternative option to the PetroDollar.