Industry News

Citi warns that surging oil prices could soon create a ‘hostile environment’ for stocks

A dramatic upswing in oil prices over recent months could soon create a “particularly hostile environment” for global investors, Citi economists warned Monday. The price of crude has risen over the past two years, from $26 in 2016 to $77 on Monday, as the balance between supply and demand has been steadily tightening. This has helped boost company’s profits too— with several oil and gas producers and refiners among the biggest gainers on Wall Street over the past month. […] Read Full Article Here: https://www.cnbc.com/2018/05/14/citi-warns-surging-oil-prices-could-create-hostile-environment-for-stocks.html

All the reasons crude oil might go back to $100 a barrel

here is a risk that oil prices could hit $100 per barrel next year for the first time since 2014, according to new research from Bank of America Merrill Lynch. It’s primarily an old-fashioned case of more demand, less supply. In an interview with Bloomberg, BofAML’s head of commodities research Francisco Blanch discusses the important dynamics driving the oil markets […] Read Full Article Here: https://qz.com/1275211/all-the-reasons-crude-oil-might-go-back-to-100-a-barrel/

The 130-Year-Old Bankruptcy That Created a $5 Billion Oil Giant

The hottest oil stock from the U.S. shale boom has never pumped a single barrel of crude. Texas Pacific Land Trust, a listed land bank created out of a railroad bankruptcy more than a century ago, has climbed more than 2,200 percent since 2010, outperforming the stocks of shale oil producers, service companies and prospectors alike. It’s now worth more than $5 billion. Its secret: vast tracts of mineral rights in the Permian Basin, the world’s hottest major oil region, earning revenues from the likes of Chevron Corp., which have to pay the trust when they produce from its land. […] Read Full Article Here: https://www.bloomberg.com/news/articles/2018-05-14/the-130-year-old-bankruptcy-that-created-a-5-billion-oil-giant

Conoco Seizes Venezuela PDVSA Products From Isla Refinery

U.S. oil major ConocoPhillips (NYSE: COP) has seized products belonging to Venezuelan state oil company PDVSA from the Isla refinery it runs on Curacao, an island official told Reuters on May 13. Conoco has won court orders allowing it to seize PDVSA assets on Caribbean islands, including Curacao, in efforts to collect on a $2 billion arbitral award linked to the 2007 nationalization of Conoco assets under late leader Hugo Chavez. “PDVSA products from the installations of the Isla refinery have been confiscated. We don’t have any way to get them,” Steven Martina, Curacao’s minister for economic development said, who did not provide the amount or value of the seized products. Conoco and PDVSA did not immediately respond to requests for comment. […] Read Full Article Here: https://www.o...

How Oil And Gas Companies Can Thrive In A Shallower Profit Pool

My computer graphics on people and natural resources. Buoyancy has returned to the oil and gas industry as prices stabilize in the $50 to $70 range. Capital spending is rebounding and new upstream projects launch weekly. In previous cycles, this is about the point where executives forgot the hard-won lessons of the downturn and began to spend again, pursing growth at the cost of efficiency. This time, however, a return to old habits could prove an existential mistake. Our analysis finds that fierce competition, technological disruption and regulatory complexity have combined to reduce the profit pool by more than 60%—difficult math that should force oil and gas executives to keep the pressure on their efforts to reduce costs and improve efficiency (see figure)[…] Read Full Article Here: ht...

Bullish investors have a lock on the oil market, putting $100 a barrel in play, market veteran says

Oil expert Tom Kloza’s bearish days are behind him. Kloza, who’s known for calling the 2015 crude collapse, isn’t ruling out triple digit a barrel oil this year. “Anything that’s between $70 and $100 [a barrel] right now doesn’t represent hyperbole,” he said recently on CNBC’s “Futures Now.” The veteran oil market watcher added: “The bulls aren’t just in charge, they’ve got a hammerlock on this market.” […] Read Full Article Here: https://www.cnbc.com/2018/05/13/oil-could-hit-100-a-barrel-tom-kloza-says.html

Saudi Arabia should expect Iran to ‘play hardball’ at OPEC’s next meeting

President Donald Trump’s withdrawal from the Iran nuclear deal is likely to exacerbate tensions between two of the world’s biggest oil producers at next month’s OPEC meeting, one analyst told CNBC Wednesday. Global oil supplies were already tightening ahead of the U.S. president’s decision to pull out of the landmark nuclear accord on Tuesday, while crude futures have since soared to multi-year highs. Yet, in a move that defied pleas from close allies, Trump said he would seek to re-impose economic sanctions on Tehran, elevating concerns about the future of the supply-cutting deal between OPEC members and allies including Russia. […] Read Full Article Here: https://www.cnbc.com/2018/05/09/saudi-arabia-should-expect-iran-to-play-hardball-at-opecs-next-meeting.html

Bahrain is betting on 80 billion barrels of oil to help clear its budget deficit

A new, massive oil discovery in Bahrain could help the island kingdom dramatically improve its economic and fiscal strength, according to analysts at Moody’s credit ratings agency. In early April, Bahrain’s Oil Minister Sheikh Mohammed bin Khalifa Al Khalifa announced its biggest discovery of hydrocarbon deposits in decades, estimated to be at least 80 billion barrels of tight oil and between 10 and 20 trillion cubic feet of deep natural gas. Found off Bahrain’s west coast, if it is verified by an international oil consortium as being technically and economically recoverable it could be a boon for the nation’s economy. Bahrain’s budget deficit was as high as 17.8 percent of gross domestic product (GDP) in 2016 and the International Monetary Fund (IMF) predicted there would be a defici...

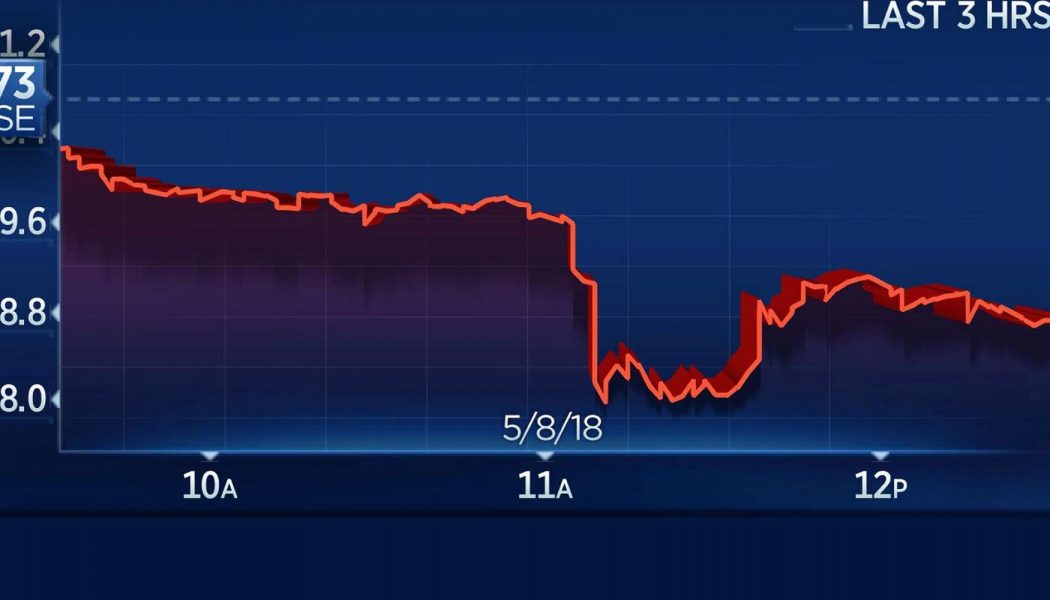

Oil prices fall in volatile trade as Trump is expected to scrap Iran nuclear deal

Oil prices fell in volatile trade on Tuesday as President Donald Trump prepared to announce his intention to restore sanctions on Iran, a move that effectively withdraws the United States from the 2015 Iran nuclear deal. Members of Congress were being informed of Trump’s decision on Tuesday, NBC News reported and CNBC later confirmed. Trump is scheduled to make his official announcement on Tuesday at 2 p.m. ET. […] Read Full Article Here: https://www.cnbc.com/2018/05/08/oil-prices-fall-as-the-market-awaits-trumps-iran-nuclear-deal-decision.html

Oil prices have surged above $70—here are 4 key reasons behind the rally

Supply concerns surrounding the possible reinstatement of sanctions on Iran aren’t the only reason for the climb in U.S. benchmark oil prices above a barrel to their highest levels since late 2014. Read Full Article Here: https://www.marketwatch.com/story/oil-prices-have-surged-above-70here-are-4-key-reasons-behind-the-rally-2018-05-07

Managing millennials in the oil and gas industry

In recent years amid low commodity prices, oil and gas companies have had to reduce their headcount to lower costs, while continuing to build their talent pipeline for future success. As a result, the number of people employed in oil and gas extraction over the age of 45 fell by 19 percent between 2012 and 2017, while employees between 25 and 34 – often classified as millennials – were the only age group to grow. With this rapid change, oil and gas companies face a new challenge: managing and retaining an influx of younger workers. It’s no surprise that personal differences – age, gender, ethnicity and background – can all play a role in creating different expectations of employers. […] Read Full Article Here: https://www.chron.com/business/energy/articl...

Cybercriminals are exposing oil and gas — but the industry is turning a blind eye

There are over a million oil and gas wells in the United States. There are also several hundred thousand miles of pipelines. Digitization is on the rise in the notoriously conservative oil and gas industry as companies wake up to the cost and operational efficiency boost that sensors and algorithms can offer them. Meanwhile, cybercriminals are keeping ahead of the learning curve, but oil and gas is largely pretending not to notice them. […] Read Full Article Here: http://www.businessinsider.com/cybercriminals-are-exposing-oil-and-gas-but-the-industry-is-turning-a-blind-eye-2018-5