@ritafarr

Active 6 years, 6 months agoYou need to log in or create an account to post to this user's Wall.

-

RittaFarr wrote a new post, Saudi Arabia WAR THREAT: Oil tankers BOMBED – Saudis BAN exports through Red Sea straits 6 years, 5 months ago

IRAN-BACKED Yemeni rebels aligned have launched an attack on two oil tankers passing through the strategically important Red Sea shipping lane of Bab al-Mandeb – prompting Saudi Arabia to announce that w […]

-

RittaFarr wrote a new post, This Is How Much U.S. Households Lose As Gas Prices Rise 6 years, 6 months ago

U.S. households are feeling the pinch and are expected to have around 0 less disposable income as higher gasoline prices are offsetting part of the tax cuts from earlier this year

Read Full Article […]

-

RittaFarr wrote a new post, Oil surges 3.6%, settling at $70.53, after US says crude buyers must cut Iran imports to zero 6 years, 6 months ago

Crude prices surged by more than 3 percent on Tuesday after the U.S. State Department said it will require companies to cut all oil imports from Iran to zero by November.

The announcement exacerbates concerns […]

-

The swings in recent days are a bit surprising, as all of the factors that are being used as the “reason” for the swings are all known data points. We knew that Iran imports were going to zero, and we all had a really good idea that OPEC, Russia and others would increase output to pick up the slack left by Venezuela… Can someone explain to me why the traders react to heavily on this news?

-

-

RittaFarr wrote a new post, Oil and gas workers still mainly old white males despite diversity gains: study 6 years, 6 months ago

A new study shows that Canada’s energy sector workforce became larger and more diverse from 2006 to 2016, but remains predominantly the domain of older, white men.

PetroLMI says the number of people […]

-

RittaFarr wrote a new post, What Happened To The IPO Market For Oil And Gas Independents? 6 years, 6 months ago

The IPO market for oil and gas independents has evaporated, as the cost of replacing assets – including leaseholds, reserves and drilling inventory – exceeds the market value of publicly traded shale com […]

-

RittaFarr wrote a new post, What is petroleum, and where does it come from? 6 years, 6 months ago

You gotta crack some plankton to make crude oil.

If you’re reading something related to fossil fuels here on ZME Science, chances are it somehow ties into the issue of pollution or global warming. B […]

-

RittaFarr changed their profile picture 6 years, 6 months ago

-

RittaFarr wrote a new post, Pope Francis Criticizes Continued Search for Fossil Fuels at Meeting with Oil Executives 6 years, 6 months ago

Pope Francis warned against the “continued search” for fossil fuels Saturday and urged a gathering of oil executives, investors and officials to meet the world’s energy needs while protecting the enviro […]

-

RittaFarr posted an update 6 years, 7 months ago

Another sign that the industry has bounced back.

https://oilprice.com/Energy/Energy-General/Hiring-Frenzy-Spurs-Wage-War-In-The-Permian.html

-

The next big wave of news will be focused on the employment market. Many talented professionals left the industry, leaving a shortage. This issue, plus the skills gap that has long been a concern is a mini tidal wave for the energy market as a whole, even with only 70% of the jobs coming back, there will still be a shortage.

-

-

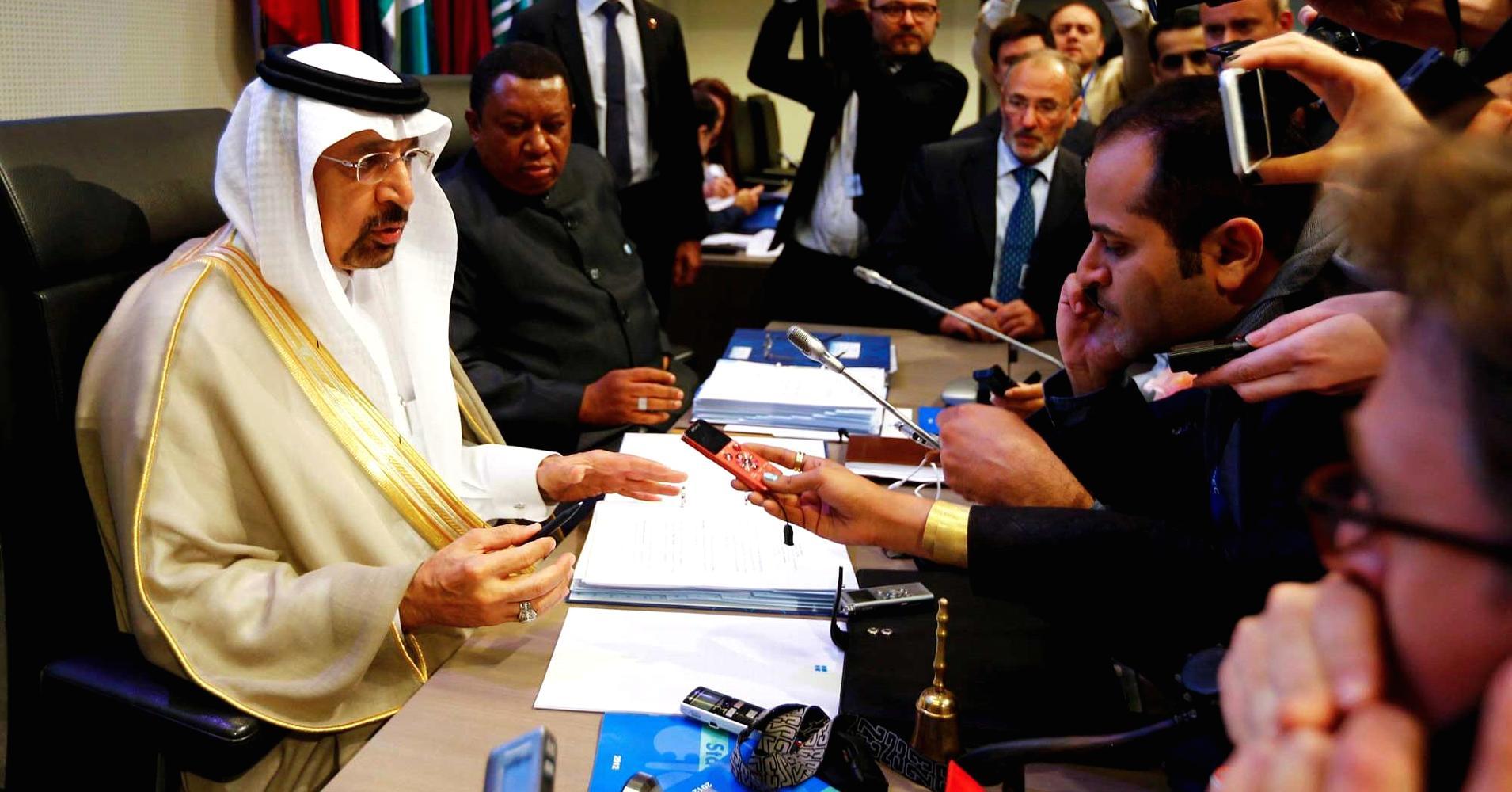

RittaFarr wrote a new post, OPEC meeting 'might be one of the worst since 2011' amid differences over supply 6 years, 7 months ago

The forthcoming meeting between OPEC and non-OPEC oil producers, including Russia, could be one of the most fractious in recent years with competing interests and demands at play, according to oil market […]

-

RittaFarr wrote a new post, Exxon Mobil criticized for worker rights and safety issues at annual shareholder meeting 6 years, 7 months ago

Exxon Mobil faced heat over worker rights and safety at its annual meeting on Wednesday but it prevailed against several shareholder demands.

Shareholders voted against four resolutions, including a […]

-

RittaFarr posted an update 6 years, 7 months ago

-

RittaFarr posted an update 6 years, 7 months agoWTI crude drops under supply pressure, but Brent ticks higherU.S. oil prices continued to lose ground on Tuesday, though Brent prices were rising, with the divergence coming against a background of potentially higher supply.

-

RittaFarr wrote a new post, The 'biggest' change in oil market history: A shipping revolution could prompt crude prices to soar 6 years, 7 months ago

The most prominent driver of oil prices over the next two years is likely to come in the shape of a shipping revolution, analysts have warned.

Read Full Article Here: […]

-

RittaFarr wrote a new post, The 130-Year-Old Bankruptcy That Created a $5 Billion Oil Giant 6 years, 7 months ago

The hottest oil stock from the U.S. shale boom has never pumped a single barrel of crude.

Texas Pacific Land Trust, a listed land bank created out of a railroad bankruptcy more than a century ago, has […]

-

RittaFarr posted an update 6 years, 7 months ago

I couldn’t agree more… Buckle up if you’re playing the short game.

http://money.cnn.com/2018/05/11/investing/oil-prices-iran-volatility/index.html

The oil market is about to get scaryAfter a prolonged period of low prices and relative calm, oil watchers are now predicting a surge of volatility following President Trump's decision to slap sanctions back onto Iran.

-

RittaFarr posted an update 6 years, 7 months agoHeart of America’s Oil Boom Can’t Fetch Good Prices for Its CrudeThe main U.S. oil benchmark, West Texas Intermediate, has soared to its highest level in years at $71 a barrel. But good luck getting that price in West Texas.

-

RittaFarr wrote a new post, Bahrain is betting on 80 billion barrels of oil to help clear its budget deficit 6 years, 8 months ago

A new, massive oil discovery in Bahrain could help the island kingdom dramatically improve its economic and fiscal strength, according to analysts at Moody’s credit ratings agency.

In early April, Bahrain’s Oil […]

-

RittaFarr posted an update 6 years, 8 months ago

https://www.bloomberg.com/news/articles/2018-05-09/here-s-what-oil-at-70-means-for-the-world-economy

Here's What Oil at $70 Means for the World EconomyRising oil prices are a double-edged sword for the world economy.

-

RittaFarr posted an update 6 years, 8 months ago

Iran is stuck between a rock and a hard place. Cutting supply with restored sanctions is unlikely…

Iran Opposes Higher Oil Prices, Signaling Divide With SaudisIran, faced with a possible restoration of U.S. sanctions, came out against higher oil prices, signaling a split with fellow OPEC member Saudi Arabia, which is showing a willingness to keep tightening crude markets.

- Load More