OPEC

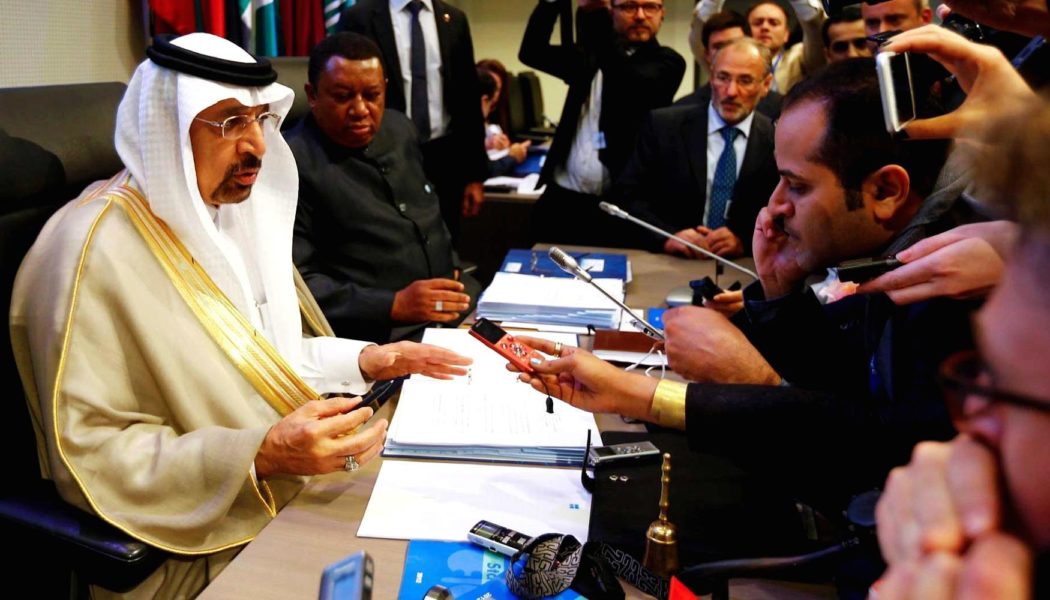

OPEC meeting ‘might be one of the worst since 2011’ amid differences over supply

The forthcoming meeting between OPEC and non-OPEC oil producers, including Russia, could be one of the most fractious in recent years with competing interests and demands at play, according to oil market experts. OPEC’s production policy will dominate the agenda when the world’s major oil producers meet in Vienna on June 22, with arguments expected over whether to increase production or maintain supply as it is. Saudi Arabia and Russia are reportedly ready to increase oil output while others like Iran and Iraq are against such a move. As such, the discussions might not be pretty, […] Read Full Article Here: https://www.cnbc.com/2018/06/07/opec-meeting-on-june-22-likely-to-see-disagreements.html

Saudi Arabia should expect Iran to ‘play hardball’ at OPEC’s next meeting

President Donald Trump’s withdrawal from the Iran nuclear deal is likely to exacerbate tensions between two of the world’s biggest oil producers at next month’s OPEC meeting, one analyst told CNBC Wednesday. Global oil supplies were already tightening ahead of the U.S. president’s decision to pull out of the landmark nuclear accord on Tuesday, while crude futures have since soared to multi-year highs. Yet, in a move that defied pleas from close allies, Trump said he would seek to re-impose economic sanctions on Tehran, elevating concerns about the future of the supply-cutting deal between OPEC members and allies including Russia. […] Read Full Article Here: https://www.cnbc.com/2018/05/09/saudi-arabia-should-expect-iran-to-play-hardball-at-opecs-next-meeting.html

Not Everyone Gets Why OPEC Is Determined to Stick With Cuts

OPEC and Russia seem determined to keep on cutting production even after their campaign to rebalance world oil markets achieved its main target. The primary justification for doing so looks shaky. Read Full Article Here: https://www.bloomberg.com/news/articles/2018-05-01/opec-s-reason-for-sticking-with-the-cuts-rests-on-shaky-ground

OPEC Cuts May Go Deeper as Another Member Sees Output Slump

While plunging output in Venezuela captures the oil world’s attention, problems are quietly festering in another OPEC nation. Angola, once Africa’s biggest crude producer, is suffering sharp declines at under-invested offshore fields, with output dropping almost three times as much as the nation pledged in an accord with fellow OPEC members. With the losses set to accelerate — a shipping program seen by Bloomberg News shows crude exports will fall in June to the lowest since at least 2008 — the cartel risks tightening supply too much. […] Read Full Article Here: https://www.bloomberg.com/news/articles/2018-04-27/opec-cuts-may-go-even-deeper-as-another-member-sees-output-slump

Kuwait: OPEC May Discuss Extending Oil Cut Deal In June

OPEC will keep its oil production cuts in place through the end of 2018 and will discuss a further extension at the June ministerial meeting in Vienna […] Read Full Article Here: https://oilprice.com/Latest-Energy-News/World-News/Kuwait-OPEC-May-Discuss-Extending-Oil-Cut-Deal-In-June.html

OPEC Deal In Jeopardy As Iran And Saudi Arabia Square Off

Iran and Saudi Arabia are at odds over what to do next with the OPEC agreement, a conflict that could sow the seeds of the agreement’s demise over the course of the next year. As the WSJ notes, the dispute centers around exactly what price the cartel should be targeting. Iran’s oil minister has said that the group should not push prices too high because it would likely spark an even greater production response from shale drillers. “If the price jumps [to] around …it will motivate more production in shale oil in the United… Read Full Article Here: https://oilprice.com/Geopolitics/International/OPEC-Deal-In-Jeopardy-As-Iran-And-Saudi-Arabia-Square-Off.html

OPEC wants to talk with rival US shale drillers to learn lessons of downturn

OPEC wants an open dialogue with U.S. shale drillers after the most painful downturn in six oil price cycles. OPEC was meeting with rival U.S. shale producers on the sidelines of the annual CERAWeek energy conference for a second year in a row, in an effort to learn what the industry can do to avoid the type of painful downturn faced in 2015. Read Full Article Here: https://www.cnbc.com/2018/03/05/opec-wants-to-talk-with-rival-u-s-shale-drillers-to-learn-lessons-of-downturn.html

Putin’s power play: Russia-Saudi oil deal a launchpad for bigger Russian influence in Mideast

Saudi Arabia’s oil production agreement with Russia was opportunistic at first, but it is now the foundation for a broader relationship. The full article, linked below goes into greater detail. The quote of the entire article is: “Right now Russia and Saudi Arabia’s relationship is becoming thicker than oil,” Croft said. As for the Saudis, “I think they see themselves as trying to show the Russians they have a better friend in the Middle East (than Iran).” Here’s a quick summary: The agreement between Saudi Arabia and Russia to cut back on oil production has boosted oil prices and is now the foundation for a broader relationship. The partnership with OPEC, led by Saudi Arabia, allows Russia to strengthen its hand in the Middle East at the same time the U.S. role has been diminished. S...

Saudi oil minister hopes OPEC, allies can ease output curbs in 2019

Saudi Arabia hopes OPEC and its allies will be able to relax production curbs next year and create a permanent framework to stabilize oil markets after the current supply cut deal ends this year, its oil minister said on Saturday. The Organization of the Petroleum Exporting Countries is reducing output by about 1.2 million barrels per day (bpd) as part of a deal with Russia and other non-OPEC producers. The pact, aimed at propping oil prices, began in January 2017 and will run until the end of 2018. Read Full Article Here: https://www.cnbc.com/2018/02/24/saudi-oil-minister-hopes-opec-allies-can-ease-output-curbs-in-2019.html

The Venezuelan oil industry is on a cliff’s edge. Trump could tip it over.

The Washington Post is reporting that the Trump Administration is threatening to embargo Venezuelan oil, in what could be another blow to an extremely fragile economy. Known for the world’s largest crude reserves, and once thriving oil and gas industry, the Venezuelan government cannot seem to get the industry to work again. Many of the countries most productive extraction sites have been idle for several months, or paralyzed by lack of maintenance and broken rigs. There is a consensus in this article and several members of Oilconvo that the PDVSA (the Venezuelan state-owned oil and gas company) is in shambles and likely going to fail. Rex Tillerson, former Exxon CEO and current Secretary of State, is guiding the president on policies that would restrict oil sales from Venezuela. Su...

Peak U.S. Shale Could Be 4 Years Away

As reported by Oilprice.com, The United States Energy Information Administration is predicting that shale oil is set to peak in the next four years U.S. shale production growth has outperformed even the most bullish forecasts, forcing OPEC and the International Energy Agency (IEA) to revise up American supply growth projections month after month. The U.S. Energy Information Administration (EIA) also expects shale/tight oil to continue to grow in all possible modeled scenarios for the next four years, according to its Annual Energy Outlook 2018 published this month. The article shares many of the EIA statistics from their report, but there is a warning on the horizon, that shale growth will widely be determined by investor confidence and market conditions. The drive to profitability and cas...

Saudi Arabia Eyes Higher Oil Prices – U.S. Shale Will Play A Role

OPEC has been on a five year mission to reduce the oil glut sloshed on the global supply by the U.S. Shale production. This mission is finally in reach, Saudi Arabia wants cuts to go further to cause a small supply shortage. The underlying result would be increase oil prices. Previously content with oil at $60 a barrel, Al-Falih is now seeing $70 as the level where crude prices should trade, according to a person familiar with the matter, who asked not to be identified to Bloomberg because the information was private. With the cost of social programs and the pending IPO of Saudi Aramco, a higher oil price would be very beneficial. However, if it’s at the cost of additional market share to the U.S. Shale industry, one questions if additional cuts will have the desired results on price. “If ...

- 1

- 2