EIA

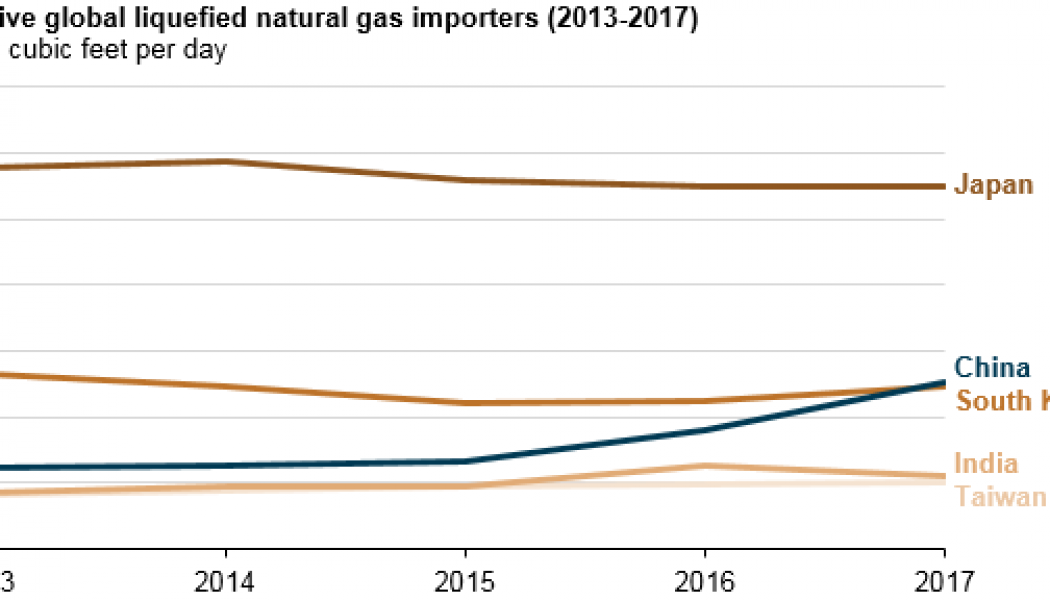

China becomes world’s No.2 LNG importer in 2017, behind Japan

Last week the EIA reported that China will become the second largest LNG importer in the world, behind Japan. Several outlets have written about this growth and what it means to the industry as a whole. The report states that China surpassed South Korea to become the world’s second-largest importer of liquefied natural gas (LNG) in 2017, according to data from IHS Markit and official Chinese government statistics. Chinese imports of LNG averaged 5 billion cubic feet per day (Bcf/d) in 2017, exceeded only by Japanese imports of 11 Bcf/d. Imports of LNG by China, driven by government policies designed to reduce air pollution, increased by 1.6 Bcf/d (46%) in 2017, with monthly imports reaching 7.8 Bcf/d in December. China’s imports of natural gas have grown to meet increasing domestic ...

Peak U.S. Shale Could Be 4 Years Away

As reported by Oilprice.com, The United States Energy Information Administration is predicting that shale oil is set to peak in the next four years U.S. shale production growth has outperformed even the most bullish forecasts, forcing OPEC and the International Energy Agency (IEA) to revise up American supply growth projections month after month. The U.S. Energy Information Administration (EIA) also expects shale/tight oil to continue to grow in all possible modeled scenarios for the next four years, according to its Annual Energy Outlook 2018 published this month. The article shares many of the EIA statistics from their report, but there is a warning on the horizon, that shale growth will widely be determined by investor confidence and market conditions. The drive to profitability and cas...

The Oil And Gas Situation: Volatility Returns, As The Market Overreacts

After a 7-month period of remarkably low volatility in the global crude oil markets, the last two weeks have seen a return of turbulence. The sudden correction that has hit stock markets around the world has in turn diminished stability where crude is concerned. A 10 percent drop in the Dow Jones Industrial average was met by a 10 percent drop in the price for WTI, as a strengthening dollar, a jump in the U.S. rig count and the preliminary announcement by the U.S. Energy Information Administration (EIA) that domestic production set a new record of 10.25 million barrels of oil per day during the final week in January led to a predictable reaction in the trader and investor communities. Suddenly, those $55 hedge contracts some U.S. producers entered into during Q4 2017 aren...